Advertisement

Kelly Walker Nov 14, 2024

What Is Overdraft Protection?

12694

Kelly Walker Oct 20, 2024

The IKEA Visa Credit Card Review

68238

Kelly Walker Oct 27, 2024

The Basics of Joint Credit: Everything You Need to Know

67975

Kelly Walker Oct 22, 2024

Top Alternatives to Zillow and Trulia

91574

Advertisement

Can You Get a Balance Transfer Card With Bad Credit?

Sep 23, 2024 By Rick Novak

Are you looking for a way to pay off high-interest debt but need better credit? It can be frustrating to try and find options to refinance your debts when your credit score could be better. Fortunately, some strategies, such as getting a balance transfer card, may work for you.

In this article, we'll discuss what balance transfer cards are, how they work while having bad credit, the pros and cons of these cards, and more. Read on to learn if a balance transfer card might be right for you!

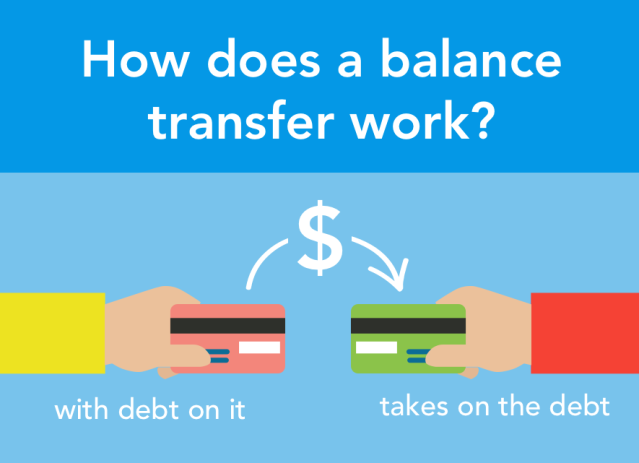

What is a Balance Transfer Card and How Does it Work

A balance transfer card is a type of credit card that allows you to transfer your existing debt onto a new card, often with a lower interest rate. This can help you pay off your debt faster and save money in the long run. Balance transfer cards have become increasingly popular as more people struggle to pay off high-interest debts.

The process works like this: when you apply for a balance transfer card, you provide information about your debts, such as loan balances, payment amounts, and interest rates. Then, the new credit card company will offer you a promotional period with a 0% APR (annual percentage rate) on transferred balances for six months (sometimes up to 24 months). During the promotion period, any payments made will go towards paying off the balance instead of interest.

However, you should be aware that to get approved for a balance transfer card, you must have at least some creditworthiness—after all, lenders want to ensure they’ll get their money back. Getting a balance transfer card with bad credit is possible, but it might require you to pay an annual fee or higher interest rates than someone with good credit would receive.

Benefits of Having a Balance Transfer Card

A balance transfer card can effectively pay off your debts and improve your credit score. Here are some of the benefits you could look forward to when getting a balance transfer card:

Low-Interest Rates

Balance transfer cards often offer promotional periods with 0% APR on transferred balances for six months or more. This means you can save money by not worrying about interest payments while you pay down your debt faster.

Improved Credit Score

Paying off debts with high-interest rates can help improve your credit score over time, as paying off debt is one factor that determines it. Furthermore, using your balance transfer card responsibly and making timely payments will further enhance your credit score.

Flexibility

Balance transfer cards typically offer flexible payment options, allowing you to choose the payment amount and frequency. This is great for people trying to pay off their debts but needing a consistent income source or finding themselves in financial hardship.

No Prepayment Penalty

Many lenders charge early repayment fees if you repay loans earlier than expected; however, balance transfer cards do not incur such penalties. This means you can make extra payments on top of your minimum required amount without worrying about additional charges.

Steps for Applying for a Balance Transfer Card with Bad Credit

When applying for a balance transfer card with bad credit, it is important to know the risks and understand what steps you need to take.

First, find a balance transfer card tailored to your needs and credit score. You may have to pay an annual fee or higher interest rates than someone with good credit, but this can still be worth it if you can find one with a 0% APR promotional period on transferred balances.

Next, read the terms and conditions carefully before making any decisions. Ensure you understand all the fees associated with the card, such as annual fees and late payment charges, so that there are no unpleasant surprises down the line.

After choosing a suitable card, it’s time to apply. You must provide some basic infection, including your current debts, payment amounts, and interest rates. Being aware of the credit check process is also important, as this can impact your application.

Different Types of Balance Transfers

When it comes to balance transfers, there are three main types you should be aware of.

The first is a direct balance transfer, which involves transferring your debt from one credit card to another without taking out new cash. This type of transfer usually has the lowest fees and can help you pay off multiple debts at once while avoiding interest payments.

The second type is a balance transfer loan, which involves taking out a loan with the bank or lender to pay off existing debt. While this option can save you money through lower interest rates and longer repayment terms, it is important to understand that such loans typically require collateral for approval.

Finally, the third type is called a secured balance transfer card. This card type requires you to deposit to receive the card, which is then used as collateral against your existing debt. While this option can benefit you with bad credit, it is important to understand that such cards typically come with high-interest rates and fees.

Tips for Making the Most of Your Balance Transfer Card

Once you have been approved for a balance transfer card with bad credit, several tips can help you make the most of it.

First, it is important to set up an automatic payment plan to make your payments on time every month. This will help ensure that your debt remains manageable and that your credit score does not suffer due to missed payments.

Second, be aware of the promotional period and pay off your balance before it expires to avoid any interest charges or potential penalties. Additionally, try to make more than the minimum payments if possible and always check for extra fees or hidden costs.

Finally, using your balance transfer card responsibly is important by avoiding additional purchases and utilizing the 0% APR period to your advantage. This will help ensure you can pay off your debt on time and build up a good credit score.

FAQs

Q: What Is the Process of Getting a Balance Transfer Card With Bad Credit?

A: Getting a balance transfer card with bad credit is similar to any other regular application. You must provide your name, address, Social Security number, and income details. It's important to ensure all the information you submit is accurate to increase your chances of approval. Once you’ve completed the application process, most banks will review it within 1-2 weeks and let you know if your application has been approved or denied. If approved, you can transfer your existing balances to the new card and take advantage of its benefits.

Q: Are There Any Advantages To Having a Balance Transfer Card With Bad Credit?

A: Yes, there are several advantages to having a balance transfer card with bad credit. For starters, you can take advantage of lower interest rates on outstanding balances and save money. Additionally, if you pay off your debts on time and manage the new card responsibly, it can help to improve your credit score over time as well. This can open up better opportunities for obtaining other forms of financing or even the possibility of refinancing existing loans at more favorable terms.

Q: Are There Any Risks Involved With Getting a Balance Transfer Card With Bad Credit?

A: There are some risks involved with getting a balance transfer card with bad credit. For one thing, if you don't make payments on time or are unable to meet the requirements of the card agreement, then you could risk further damaging your credit score and having your account closed. Balance transfer cards often come with fees and charges that can add up quickly if not managed properly. So before applying for any balance transfer card, it's important to do your research and read all the terms & conditions carefully so you know what you're getting into.

Conclusion

A balance transfer card can be an effective way to pay off debts and improve your credit score. When applying for one with bad credit, make sure you understand the risks involved and take steps such as finding a tailored card with minimal fees, reading the terms and conditions, and understanding different types of balance transfers. You can find a card that best suits your needs with careful consideration and research.

Rick Novak Aug 14, 2024

What Is a Systematic Investment Plan (SIP)?

62590

Kelly Walker Aug 18, 2024

How to Maximize Cash Back Rewards with USAA Bank Credit Cards?

18488

Kelly Walker Dec 08, 2024

Citi Custom Cash Credit Card Review

4124

Rick Novak Jan 19, 2025

Cash-in on These Banks with Ridiculously High Dividends

17938

Kelly Walker Dec 03, 2024

What Is Robo-Advisor Tax-Loss Harvesting?

61132

Rick Novak Nov 30, 2024

What is Form 2441: A Definition of Child and Dependent Care Expenses

79912

Rick Novak Oct 01, 2024

Pros and Cons of Secured Personal Loans

78463

Rick Novak Jan 13, 2025

RHS Loans and Their Ins and Outs

61685